Growler Industry Prospective:

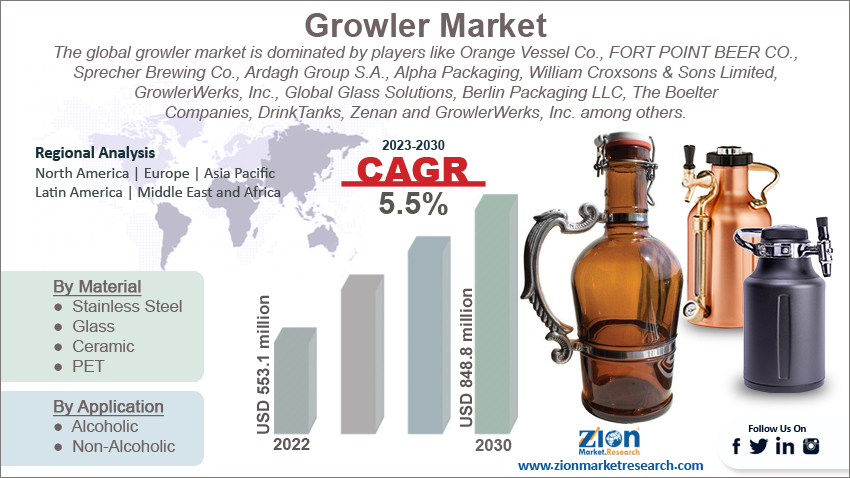

The global growler market size was worth around USD 553.1 million in 2022 and is predicted to grow to around USD 848.8 million by 2030 with a compound annual growth rate (CAGR) of roughly 5.5% between 2023 and 2030.

The report analyzes the global growler market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the growler industry.

Growler Market: Overview

Growlers are glass, plastic, and ceramic bottles that are used in the packaging industry and offer a practical way to transport large quantities of draught beer and other liquids. While retaining product quality, it makes shipping, brewing, and serving processes easier. It is frequently used for storage and serving in wine and beer establishments. The demand for collectible growlers is booming due to the fast growth of craft breweries and the rising popularity of home brewing.

They are frequently constructed of glass and have a porcelain gasket lid that can be hinged or a screw-on cap that can keep beer cold for up to a week. They may be kept in the same manner as any other cleaned bottle since they hold their carbonation for an extended period when properly sealed. Some growler lids come equipped with valves that replace the carbon dioxide that is lost when racking. The two most common growler colors are transparent (commonly referred to as “flint”) and amber, a brownish tint. Usually, clear growlers cost 25% to 35% more per unit than amber ones.

The most common growler handle is made of glass, however, metal handles with more elaborate designs are also offered. The growler’s market is driven by several factors including the growing beer industry, expansion of the crafted beer market, increasing product launches, and changing consumer preferences.

Key Insights

- As per the analysis shared by our research analyst, the global growler market is estimated to grow annually at a CAGR of around 5.5% over the forecast period (2023-2030).

- In terms of revenue, the global growler market size was valued at around USD 553.1 million in 2022 and is projected to reach USD 848.8 million, by 2030.

- The increasing consumption of alcohol is expected to drive the growth of the growler market during the forecast period.

- Based on the material, the glass segment is expected to dominate the market over the forecast period.

- Based on the application, the alcoholic segment is expected to hold the largest market share over the forecast period.

- Based on the sales channel, the online segment is expected to grow at the highest CAGR during the forecast period.

- Based on region, Europe holds a significant market share over the forecast period.

Request Free Sample

Request Free Sample

Growler Market: Growth Drivers

The rapid expansion of craft beer drives the market growth

Craft beer has been steadily expanding its market share as more independent microbreweries pop up to provide a wide range of goods. The primary growth driver for craft beer is expected to be its increasing consumer appeal, particularly among younger customers. Demand for variety, more disposable income, a preference for flavor, and beer quality are factors influencing the move toward craft beer consumption.

Beverages with little alcohol by volume are becoming more and more popular. Due to rising interest from consumers who are health-conscious and a larger range of new kinds with superior flavor, sales of low- and no-alcohol beers have also surged. The rise in consumer need for variety is inextricably associated with the expansion of the craft beer business. For instance, The Brewers Association estimates that there were 9118 craft brewers in the United States in 2021, up from 8391 in 2019. Thus, the aforementioned fact supports the global growler market growth during the forecast period.

Growler Market: Restraints

Rules and regulations associated with alcoholic beverages act as a major restraint in the growth of the market

Growler distribution and sales may be constrained by region-specific laws and license requirements. These rules may make growlers less accessible or restrict the way growler filling stations can operate, making it harder for companies to provide growlers as a service. Local alcohol laws and regulations compliance might be a hindrance to the growler market’s expansion. Similarly, the growing government and NGO initiatives regarding consumption and its adverse impact on human health are further hampering the market growth.

For instance, 60% of U.S. adults used alcohol in 2021, down from 65% in 2019. This statistic was provided by Gallup, Inc. In the past seven days, fewer people on average drank than before. The average number of beverages consumed by consumers who are 18 years of age and older during a week decreased from 4.0 in 2019 to 3.6 in 2021. Thus, this is expected to be a major restraint to a certain extent.

Growler Market: Opportunities

Increasing online and direct-to-consumer sales offers a significant opportunity

Breweries and merchants can offer growlers to customers directly through e-commerce and online channels. Breweries may reach a larger audience with online sales in addition to their physical site and taproom. Online platforms may serve beer fans who wish to visit various breweries and access a range of beers without leaving their homes by providing a simple and quick way to order and transport growlers. For instance, IWSR reports that over three-quarters of US, customers would rather pay a few dollars more to order beverages online than go to a nearby store. Thus, this is expected to offer a lucrative opportunity for growler industry growth during the forecast period.

Growler Market: Challenges

The high cost of growlers poses a major challenge to the market growth

Growlers are a reusable and environmentally beneficial beer packaging solution, although they can be expensive for customers to purchase upfront. When compared to buying single-use bottles or cans, growler purchases can be more expensive, particularly those made of high-quality stainless steel. The cost may also be increased by some brewers’ deposit requirements or higher growler fill fees. Thus, the high cost of growlers is expected to pose a major challenge to growler market expansion during the forecast period.

Growler Market: Segmentation

The global Growler industry is segmented based on material, application, capacity, end user, sales channel, and region.

Based on the material, the global market is bifurcated into stainless steel, glass, ceramic, and PET. The glass segment is expected to dominate the market over the forecast period. This is due to the widespread use of glass in the packaging and storage of alcoholic drinks including beers, wines, and spirits, which come in a variety of alcohol concentrations. Glass also offers a clear medium, which can boost beverage sales by showcasing appealing colors. A tinted glass medium is also more environmentally friendly than plastic substitutes since it doesn’t fade over time.

The benefits of glass bottles are now being acknowledged as customers become more environmentally concerned. To address the environmental issues brought on by single-use plastic bottles, various bottle producers are creating organic, multipurpose, and recyclable glass bottles. Besides, the ceramic segment is expected to grow at the highest CAGR during the forecast period.

The segment growth is attributed to its temperature-regulating properties. Compared to other materials like glass, ceramic growlers are recognized for their insulating qualities, which can assist keep the beer’s temperature for a longer period. Customers that value temperature control may find this fascinating, especially for beers that require a certain serving temperature. Thereby, driving the segment growth over the forecast period.

Based on the application, the global growler industry is divided into alcoholic and non-alcoholic. The alcoholic segment is expected to hold the largest market share over the forecast period. This is attributed to the increasing consumption of alcohol especially in the region like Asia, Europe, and others. For instance, according to the NFHS Survey 2021, around 150 million individuals (15 and over) in India use alcohol (10% of all adults). According to the NFHS (National Family Health Survey-5), alcohol consumption among adult women (15 years and older) is 1.3%, whereas it is 18.8% among adult males (15 years and older). Thus, this is expected to drive the growth of the market.

Based on capacity, the global market is bifurcated into 128 ounces, 64 ounces, and 32 ounces.

Based on the end user, the global growler industry is segmented into commercial and residential.

Based on the sales channel, the growler market is segmented into online and offline. The online segment is expected to grow at the highest CAGR over the forecast period. The segment growth is owing to the ease of purchasing products. Moreover, the rapid expansion of e-commerce platforms is due to increasing investment in network infrastructure and growing government initiatives across the globe. Thus, these factors help to drive the growth of the online segment over the forecast period.

Growler Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Growler Market Research Report |

| Market Size in 2022 | USD 553.1 Million |

| Market Forecast in 2030 | USD 848.8 Million |

| Growth Rate | CAGR of 5.5% |

| Number of Pages | 208 |

| Key Companies Covered | Orange Vessel Co., FORT POINT BEER CO., Sprecher Brewing Co., Ardagh Group S.A., Alpha Packaging, William Croxsons & Sons Limited, GrowlerWerks Inc., Global Glass Solutions, Berlin Packaging LLC, The Boelter Companies, DrinkTanks, Zenan and GrowlerWerks Inc. among others. |

| Segments Covered | By Material, By Application, By Capacity, By End User, By Sales Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 – 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Growler Market: Regional Analysis

Europe is expected to hold a significant market share over the forecast period

Europe is expected to hold a significant global growler market share over the forecast period. This is due to a change in lifestyle resulting from a significant increase in disposable income, which increases demand for high-quality and variety of growlers in the European market. To meet rising demand from consumers, businesses are acquiring both large and small enterprises to expand their growler product line in Europe. However, the Asia Pacific is expected to experience significant growth during the forecast period.

The growth in the region is attributed to the growing disposable income of the population and the presence of major players like Drifters, Krome Brewing, and others. For instance, in October 2021, Drifters Brewing Company announced the opening of its sixth growler station in Mumbai, India. Growler stations are locations where growlers may be refilled with beer. Because of the increased demand among beer consumers in India, the newly introduced growler station is designed as a pickup and delivery service for quickly filling growlers. Thus, this is expected to drive market expansion in the region.

Growler Market: Competitive Analysis

The global growler market is dominated by players like:

- Orange Vessel Co.

- FORT POINT BEER CO.

- Sprecher Brewing Co.

- Ardagh Group S.A.

- Alpha Packaging

- William Croxsons & Sons Limited

- GrowlerWerks Inc.

- Global Glass Solutions

- Berlin Packaging LLC

- The Boelter Companies

- DrinkTanks

- Zenan and GrowlerWerks Inc.

- Others.

The global growler market is segmented as follows:

By Material

- Stainless Steel

- Glass

- Ceramic

- PET

By Application

- Alcoholic

- Non-Alcoholic

By Capacity

- 128 Ounces

- 64 Ounces

- 32 Ounces

By End User

- Commercial

- Residential

By Sales Channel

- Online

- Offline

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa